By Frank Piller, General Manager Products at TÜV Rheinland Japan

Renewable energy. Energy efficiency. Energy conservation. Energy storage. Hotly discussed topics all of them – indicating that energy has become one of the most important issues of our time.

Renewable energy. Energy efficiency. Energy conservation. Energy storage. Hotly discussed topics all of them – indicating that energy has become one of the most important issues of our time.

The Paris Agreement at COP21 and the 2015 United Nations Climate Change Conference last November are evidence of global momentum.

Important strides have been made in Japan, too, culminating in total electricity deregulation which went into law just a few days ago. This article provides a closer look at Japan’s electric utility industry law and regulations and history leading up to the recent developments.

Electricity Deregulation in Japan

Total electricity deregulation went into force on April 1, 2016. Since last year, companies from various fields have announced to enter the power retail market, many cases of which were reported prominently in mass media.

New entrants may reach up to as many as 200 companies and it is reported that around 105,000 households have already applied to change their electricity supply contract.

Japan’s first reorganization of the Electric Utility Industry Law took place in 1950. Since then, 10 electricity companies have been exclusively and stably supplying power.

The electricity market is said to have a size of approximately 750 billion yen, generated from 85 million households. It is even bigger than the Japanese mobile phone telecommunications market at 700 billion yen.

More and more newcomers are expected to enter this market, and it is estimated to sharply increase in competitiveness.

The Japanese Power Retail Market

Japan has introduced a phased deregulation of its power retail market. Based on an amendment of the Electric Utility Industry Law in 1995, deregulation started with electricity supply to large-scale users.

In March 2000, large scale manufacturing plants, department stores and office buildings categorized as “special high voltage” were allowed to freely choose their electricity company.

In 2004 and 2005, the target was expanded to include small to medium scale manufacturing plants and office buildings. They are categorized “high voltage.”

Effective April 2016, deregulation is also applicable for small scale users including households and retailers, which fall under the “low voltage” category.

Recent Trends

After the Great Kanto Earthquake followed by the Fukushima Nuclear Power Plant incident in 2011, electricity is regarded from a totally different viewpoint in Japan. The shortage of power supply has become a critical issue and renewable energy and energy saving has attracted more attention than ever before.

The Japanese government has introduced “Feed-In-Tariffs” to promote power generation by renewable energy, which resulted in a boom in large scale solar power plant construction.

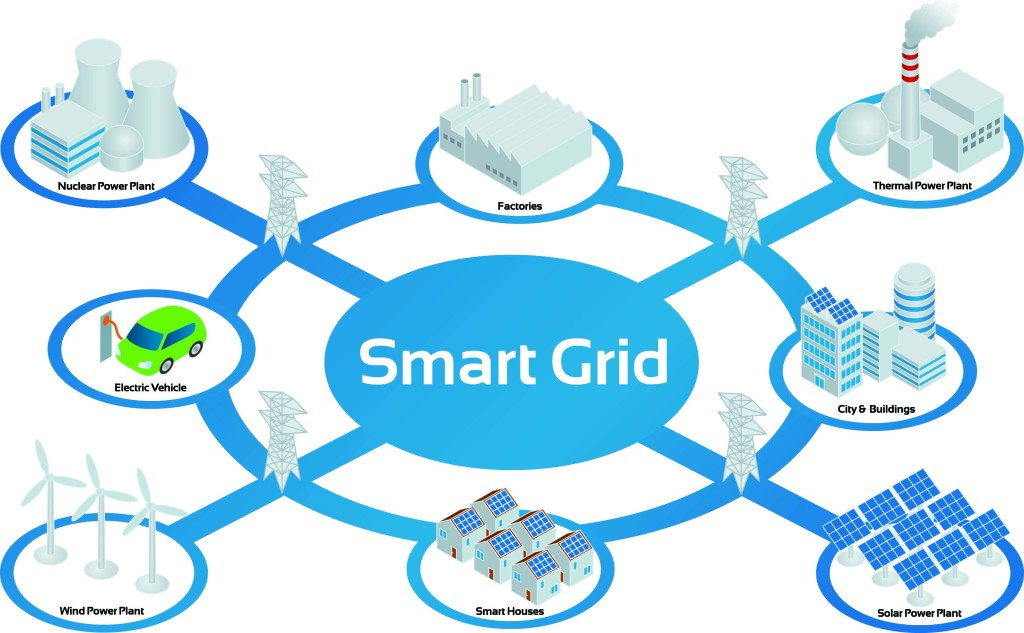

In parallel, intelligent power infrastructure has arisen as an issue to be addressed – namely the development of Smart Grid based on technologies such as Smart Meter, HEMS, BEMS, FEMS or CEMS.

BEMS: Building Energy Management System

FEMS: Factory Energy Management System

CEMS: Community Energy Management System

Another important technology called “Demand Response” is also currently under development. Aimed at realizing stable energy supply, it based on the enhancement of wireless technology. The technology plays a significant role in the operation of the electric grid by reducing or shifting the electricity usage during peak. Demand response programs are being used by electric system planners and operators as resource options for balancing supply and demand.

The Role of Renewable Energy in Japan

Roughly 80 percent of Japan’s energy supply is based on fossil fuels mainly imported from other countries. The promotion of renewable energy usage is an urgent need as there are no concerns of depletion and it brings about stable energy supply. Another expectation for renewable energy is that it will create new jobs and human resource development relevant to the environment.

Photo courtesy of TUV Rheinland Japan

Still, the usage of renewable energy, with the exception of hydroenergy, is still low at 4 percent of all electric power in Japan.

One advantage of electricity deregulation is that it offers an option for households to select which power source they want to use. The more households select power generated by renewable energy, the more business will be created and investment attracted.

History of Power Generation in Japan

The first electricity utility company was established in 1887 in Tokyo. It was followed by companies in Kobe, Kyoto, Osaka, Nagoya and Yokohama. In 1891, the ministry of communications announced to supervise Japan’s electricity supply business. The Electricity Utility Industry Law was enacted in 1911.

After World War II, energy consumption dramatically increased along with the rapid growth of Japan’s economy, leading to a need to construct large scale power generation facilities.

Data shows that power generation increases are closely related to the development of technology, for example the diffusion of radio in 1930, black and white TV, washing machines and refrigerators in the 1960s, air conditioners and microwave ovens in the 80s and the internet in 2000.

Current Japanese Regulations

An “electric facility” is defined as the equipment and facility for power generation, substation and transmission and distribution and is basically regulated by the Electricity Utility Industry Law. Electric facilities include machines, devices, dams, channels, reservoirs and electric lines.

The law was first enacted in 1964 and is governed by the Ministry of Economy, Trade and Industry. Total electricity deregulation to allow free power retail in 2016 is expected to lead to an acceleration of further technological development and business expansion.

In April 2020, the electricity market will see a further change with the enforcement of “separation of electrical power production from power distribution and transmission.”

Outlook for Japan’s Energy Market

After the adoption of the Paris Agreement at COP21 and the 2015 United Nations Climate Change Conference last November, business opportunities in the energy efficiency sector are expected to grow.

Twenty years ago, consumers were asking for product safety. A few years later, EMC testing was added to consumer products.

Today, consumers are asking for energy efficiency.

The three corners of the TUV Rheinland triangle logo symbolize the interaction of man, technology and the environment. We want to contribute to the development that energy consumption becomes more sustainable and will be continuously reduced.

Photo credit: Mount Fuji by TANAKA Juuyoh (田中十洋) via Flickr

No comments yet.