In December 2015, the Japanese Government made two major announcements: The Japan Tax Reform 2016 and the signing of a revised tax treaty with Germany. What are the drivers behind the reform and the treaty revision and what impact will they have on doing business in Japan?

Fiscal policies of the Japanese Government aim at growth and bringing forward Japanese businesses. At the same time, they target to consolidate public finances. Accordingly, while on the one hand corporate tax headline rates are reduced to push the effective corporate tax into the twenties percentage bandwidth, the tax base is being broadened on the other.

In alignment with the OECD, Japan is a frontrunner in combatting aggressive tax planning and harmful tax competition by multinational companies.

In October 2015, Japan and 60 other countries have signed a final report on Base Erosion and Profit Shifting, in which the signatories pledge to take 15 actions against what they describe as tax abuse. Through this agreement, they commit to increasingly unify transfer pricing policies, to introduce standardized country by country reporting and aim at more transparency.

Both the Japan Tax Reform 2016 and the new Germany-Japan Tax Treaty are the first two stages of Japan implementing these new policies. The new Germany-Japan Tax Treaty is of interest to readers from other countries as well, as by the end of 2016 similar rules may be agreed on a multilateral basis among many countries.

At the same time, the EU in January 2016 announced how to implement country by country reporting rules in Euroland. Let’s have a look at what’s going on.

The OECD BEPS Project

Under its charismatic director for tax policy and administration, Pascal Saint-Amans, the OECD has spent three years to mobilize the G20 and 40 more countries. In October 2015, they agreed and finalized a comprehensive report on actions against base erosion and profit shifting (“BEPS”). The signatory countries commit to implement this report in various degrees. There are 15 action plans, such as:

Action Plan 1: On Addressing the Tax Challenges of Cyberspace

The digital economy, by its nature, is more or less borderless, which creates difficulties for tax authorities when trying to get hold of digital trades, enforcing VAT or when assessing the tax presence of e-commerce.

Japan took action to tax digital trade in the tax reform 2015 and determined that digital sales to corporate customers (B2B) shall be taxed at the place where the customer has its head office.

Due to a “birth defect” of these rules, B2B services received for example by a foreign bank operating in Japan through a branch were not subject to Japanese Consumption Tax. However, Consumption Tax had to be paid on B2B services received by a Japanese bank’s foreign branch when the transaction took entirely place overseas.

The tax reform 2016 corrects this birth defect.

Action Plan 2: On Neutralizing the Effects of Hybrid Mismatch Arrangements

In the classical meaning a hybrid is the offspring of two plants, animals or engines.

In the world of taxation, hybrid arrangements make use of characterizing the same animal, such as a silent partnership, a participatory right, etc. in one country as a debt instrument while in the other country it is treated as a dividend or partnership.

As a result, payments on a silent partnership or participatory right in Japan may be treated as a deductible interest, subject to 10 percent or 20 percent withholding tax, while the receiving country may exempt them from tax.

The new Germany-Japan tax treaty will switch-over from the beneficial exemption method to the less favorable tax credit method.

This means Game Over for attractive tax structuring with hybrid instruments.

Action Plan 6: On Preventing the Granting of Treaty Benefits in Inappropriate Circumstances

This is another important issue the new treaty is tackling. So-called “treaty shopping” for tax treaties with intriguing benefits, such as the withholding exemption from dividends, interest and royalties will only be allowed for those who have substantial business activities in one of the treaty countries.

The ice for treaty benefits will brake when 65 percent of the ultimate shareholders are not resident in one of the treaty countries. The ice will be strong enough if the receiving entity is listed on a registered stock exchange, disregarding where the shareholders reside.

On the other hand, companies will have to prove that the principle purpose of their dealings is not simply aimed at treaty benefits but that they pursue legitimate business purposes.

Action Plan 13: On Transfer Pricing Documentation and Country-by-Country Reporting

In Action Plan 13, the OECD aims to globally standardize transfer pricing documentation and requires Country-by-Country (“CbC”) Reporting.

Under Country-by-Country Reporting, the pie of tax revenues and its recipe will be made transparent to all countries in which a multinational enterprise is operating. The reporting will disclose the taxable income in each jurisdiction in which a multinational is operating, its local revenues, tax accrued and paid, capital, intellectual property rights, employees, etc.

Countries will envy others where fewer revenues are recorded or less value created, but comparatively high income is recognized – and needless to say they will be even more than suspicious if those countries impose lower tax than they do.

As a consequence, companies will be compelled to make every effort in demonstrating that they have fairly allocated their pie of income in accordance with acceptable transfer pricing principles.

When is the first relevant period for filing a Country-by-Country Report in Japan and when is the submission date?

The first year of CbC Reporting will be the year commencing on or after April 1, 2016 and it will need to be submitted within one year of the year end.

Who creates the CbC Report and when is it submitted in Japan?

The parent company has to create and submit the CbC Report to the tax authority it is resident in. Companies with global consolidated sales of less than 100 billion yen in the most recent financial year will be exempt from filing the report.

In addition to the CbC Report, Action Plan 13 requires that a master file and a local file shall be prepared.

The master file provides high level information about a multinational company’s business, transfer pricing policies and agreements with tax authorities in a single document available to all tax authorities where the company has operations. Groups with global consolidated sales of less than 100 billion yen in the most recent financial year will be exempt.

In the local file, detailed information about a company’s local business, including related party payments and receipts for products, services, royalties, interest, etc. must be furnished.

The first year in which the local file has to be submitted is the year commencing on or after April 1, 2017. The deadline for submission in Japan is at maximum three months, unlike many other countries, where nine months or even one year are allowed.

The local file may be submitted in Japanese or English, but may need to be translated into Japanese upon request of tax examiners.

Japan Tax Reform 2016

Corporate and Enterprise Tax

In pursuit of its Abenomics-dubbed fiscal policies, the Japanese Government aims to push the effective corporate tax into the twenties percentage bandwidth. At the same time, the government is heavily expanding the Enterprise Tax base in a strategy of spreading tax burden over a wider group of companies, thereby reducing the burden on profitable companies and allowing them to grow.

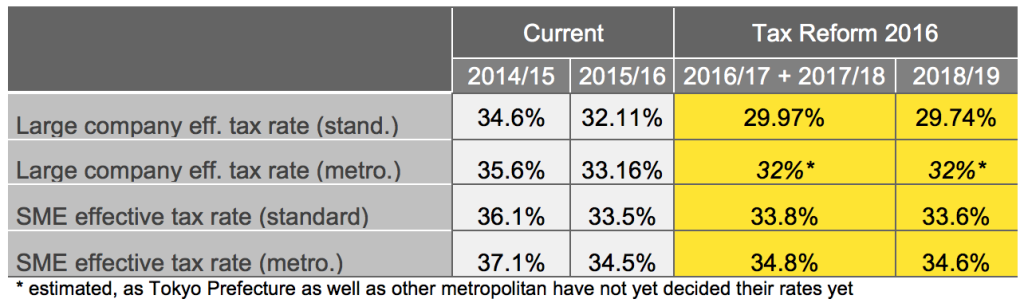

The effective tax rates of small and mediums sized enterprises (SME’s) with share capital of up to 100 million yen taxation remains unchanged. As a result, the tax rates of corporates will vary widely, depending on their share capital and headquarter location.

The gap between SME’s and large company headline tax rates as well as between local and metropolitan area rates is getting wider and wider.

Why do SME’s have to pay higher headline rates?

Technically this is because SME’s pay 9 percent and 10 percent Enterprise Tax on income, while the levy on larger companies has been and will further be reduced from formerly 7.2 percent to currently 6 percent and finally 3.6 percent.

Now, the reason why SME’s have to pay more is that Enterprise Tax for small and medium sized companies is assessed only on income; whereas larger companies are being taxed on income and sized-based factors such as salaries, interest and rent. In return they pay less Enterprise Tax on income.

As of business years beginning April 1, 2016 the income levy’s portion for large companies will be getting smaller while the sized-based factors will be getting bigger.

Even worse, on local level the former tax rates on salaries, interest and rent will increase from previously 0.48 percent to 1.2 percent and may in metropolitan areas be magnified by the factor 2.0, up from formerly 1.2.

The capital levy, which was once imposed at a rate of 0.2 percent will increase to 0.5 percent and could double in big cities, meaning it may be five times as high as before. It should be noted that the Tokyo Metropolitan Government has not yet decided its rates, so we will have to wait for the actual metropolitan factor.

The 3.6 percent income levy in Tokyo could increase to up to 7.2 percent. This is why it may be estimated that the effective tax rate in Tokyo or Osaka could become as high as 32 percent – or even higher.

Companies should carefully consider if it is more effective to have a share capital of 100 million yen or less and pay no Enterprise Tax of the size-based factors, or swallowing the bitter pill of being subject to size-based enterprise tax and enjoy effectively 3 percent lower income tax rates.

Also, those who move their head office to local areas may benefit in future even more from lower Enterprise Tax rates.

Consumption Tax

The Consumption Tax will rise from 8 percent to 10 percent as of April 1, 2017. Different from the prior law on the increase from 5 percent to 8 percent in 2014, this time no junctim clause is in place providing for an emergency brake in case that the economy is about to slip into a recession.

The junior coalition partner of the LDP and the Japanese agriculture, press and retail industries were successful in lobbying for a reduced rate of 8 percent on food, drinks – excluding alcohol and restaurant business or the like – and newspapers. So from 2017, your answer to the question if you “eat in or take out?” in hamburger restaurants and coffee bars will have an impact on the amount you pay.

An unwelcome side effect of increasing Consumption and VAT tax rates are fraudulent acts to cash-in input tax credits, such as through criminal carousel sales schemes.

Proper implementation of the European-style invoice method is an absolute must for the authorities when combatting such crimes. Therefore, from 2021 on the retention of qualified invoices will be a requirement for receiving input consumption tax credits in Japan.

This will mean serious IT and compliance changes and additional administrative burdens for companies.

And by then, time will be up for getting consumption tax credits for purchases by simply booking them as such in the accounting systems.

The New Germany-Japan Tax Treaty

After more than six years of negotiations, the new treaty was signed in December 2015 on governmental level and will need to be ratified by the German and Japanese parliaments to become effective as of Jan. 1, 2017.

The new treaty brings down withholding taxes on qualified dividends, interest and royalties to zero. To avoid the burden of 10 percent withholding tax on dividends, many companies had retained their earnings in Japan. From 2017 onward they will be able cash in the fruits of their patience.

The exemption of interest under the new Germany-Japan Tax Treaty is noteworthy because, different as is the case with other treaties, the exemption is not restricted to financial institutions.

Photo credit: Frankfurt Skyline by Andre Douque via Flicker

The new treaty incorporates a number of the OECD Action plans outlined above, such as mandatory arbitration in cases where the German and Japanese tax authorities cannot agree within two years. Arbitrators will then take over and are able to settle the matter in dispute.

If a tax payer deliberately chooses Germany as a beneficial holding location (“treaty shopping”), without operating a substantial business, he may be denied treaty benefits, such as the exemption from withholding tax. Only if certain test criteria are met under the so-called principle purpose tests, treaty benefits may be claimed.

German residents, who work in both countries or have returned to Germany after having stayed in Japan and who are rightfully taxed in Japan with Japan-sourced income are currently not being taxed at all in Germany.

Further to the so-called “exemption method” under the old treaty, Germany took the position that one-time taxation in Japan is enough – even if Japan had applied tax rates as low as 20 percent.

Under the new treaty, German residents will be taxed a second time in Germany. Double taxation will not be avoided by the exemption method but by merely giving credit for Japanese tax.

In the end, German standard income tax rates as high as 45 percent will come into effect and Japanese taxes paid will simply be credited against German income tax.

In Conclusion

The new Germany-Japan Tax Treaty will bring relief from withholding tax on dividends, interest and royalties – but also from benefits, such as lower taxation of expats returning to Germany. Similar rules may be agreed on a multilateral basis among many countries in the future.

It is important to understand that the OECD’S BEPS Action Plan affects much more than a company’s tax department.

Management needs to be aware of the risks, which its reputation and brand are exposed to when things go wrong.

Sales and marketing people will need to acknowledge that the performance and presence in certain markets will be scrutinized.

Authorities will have much more transparency in the future on how each sales area is performing. Operating models and key performance data may need to be reconsidered in the one or other market.

But many tax planning opportunities still remain.

For example, local taxes will become more important and companies should carefully consider the effect of size-based taxation, which will dramatically rise. Decreasing or increasing share capital is an option; companies should calculate the effects of being subject or not being subject to this tax. Moving headquarters while leaving some functions in Tokyo may be an alternative for those with business premises outside the metropolitan areas.

No comments yet.