Updated Feb. 8, 2026. The industrial machinery market is constantly growing. Between 2000 and 2014, global production value of machine tools more than doubled from under $40 billion to over $80 billion. Since then, the market continued to expand, reaching 91 billion in 2025. And the market is becoming more and more international. As in other industries, Asia has become one of the most important markets worldwide.

With China, Japan and South Korea beside Germany and the U.S., three of the five largest machine consumers in 2025 hailed from Asia. Other countries like Taiwan or Vietnam are becoming important manufacturers and buyers, too.

With Japan, Asia is also home to one of the most established and developed markets: The Japanese machinery industry is of global renown for its high quality brands.

Industry Overview

There are around 200 manufacturers of machine tools in Japan. Some of the most famous brands include DMG Mori, Yamazaki Mazak, Okuma and Fanuc. In 2014, six out of 11 largest machine tools manufacturers in terms of revenue came from Japan: Amada Co. Ltd., Komatsu Ltd., DMG Mori Co. Ltd., Makino Milling Machine Co. Ltd., Jtekt Corp., and Okuma Corp.

Their machines are very popular, especially in Europe. The U.S. has increasingly become a major importer of machine tools over the years. U.S. machine tool imports have continued to grow from $8 billion in 2013 to $10 billion in 2015, and further climbed to approximately $13 billion in 2023.

The global rise of machine tool consumption presents a clear opportunity for Japan’s manufacturers.

In order to grow in the European market, Mori Seiki has merged with German manufacturer Gildemeister to create DMG Mori. In recent years Europe has remained an important market for Japanese builders, and many firms continue to report double‑digit shares of sales from Europe in company disclosures.

Yamazaki Mazak Corp. is also actively working the European market. The Japanese company has opened four research centers in the past six years: Katowice in Poland, Prague in the Czech Republic, and Duesseldorf and Leipzig in Germany. In May 2016, Mazak has announced the opening of its technology center in Hungary, the 14th in Europe. Overall, the European market represents 30 percent of Mazak’s turnover.

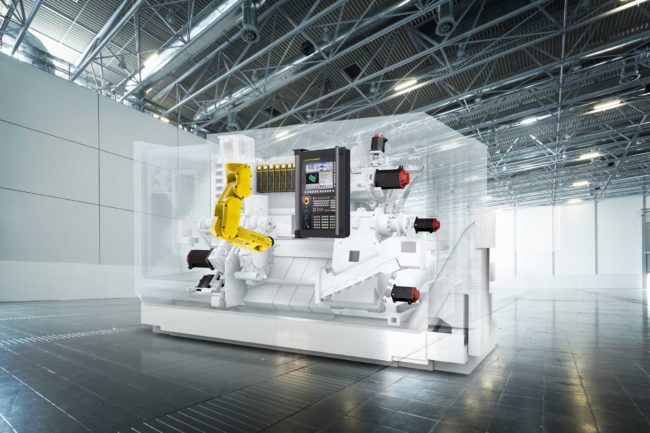

Fanuc Corp. controls around 50-60 percent of the global market share in CNC controls worldwide, making it the leading supplier in this segment, although its share has slightly decreased from the previous figure of 65%. The company has been included in the Top 100 Global Innovators list by Clarivate (formerly Thomson Reuters) in recent years, with recognition continuing into 2020 for its innovative work in automation, robotics, and CNC technology.

Fanuc is represented in over 45 countries worldwide, including 14+ countries in Europe, and has been actively developing the Chinese and South Korean markets in recent years. The company’s largest market is America, with 2022 sales estimated at $1.5 billion, closely followed by Japan with $1.1–1.2 billion in sales.

A considerable strength of many companies in the Japanese machinery industry is that they have deep market knowledge due to their long history. Japan Steel Works Ltd. for example was founded in 1907, Yamazaki Mazak in 1919, Mori Seiki tracks back its history to 1948, and Fanuc does to 1958.

Industrial Machinery: A Highly Competitive Market

Yet, Japanese machinery companies need to be aware of the fast development of China and India. India’s machine‑tool sector and domestic manufacturing have expanded in the 2010s and early 2020s, and India is now an increasingly important regional producer and consumer, though its absolute machine‑tool output remains below China’s.

According to Yoshino Hiroyuki, former president of Honda Motor, Japan has to work and focus on the price of their machines, which may be too expensive when compared to Indian and Chinese equipment. “In our newly operational factory in Thailand,” he said. “We have introduced to our engine processing line machine tools made in India and China that cost around 40 percent less than machines made in Japan. The results have been impressive. Japan needs to reconsider the question of cost.”

Paradoxically, while being an important machinery manufacturing country itself, China is also still a significant importer. In recent years China has remained the world’s largest machine‑tool consumer by value; Gardner reported China’s machine‑tool imports and consumption as the largest single market in the 2020–2023 period. Of those imports, Japan has continued to be a major supplier.

But Chinese groups such as Dalian or Spark have made several acquisitions in order to gain new knowledge and skills and can be expected to become challenging competitors to Japanese companies in the upcoming years.

Photo: Bonuterra

Japanese machinery industry companies still hold a few aces, though. Even if their machines are expensive, they are famous for their quality and reliability. They have succeeded in building extremely strong brand awareness and have customers that are very loyal.

An interesting feature of the industrial machinery sector is that equipment can be very expensive, but can also last a long time if it is properly maintained. Due to this there is a substantial market for used machinery. With the onset of the internet and the appearance of online market places to buy and sell used machinery like Exapro, this second-hand market is growing quickly. As they provide easy and transparent access to buyers all around the world, these market places also contribute to the ongoing internationalization of the industrial machinery industry.

Due to their excellent reputation and reliability, Japanese machines are very popular in the used machines sector. They are bought by small businesses all around the world who want to launch their activities with a lower price machine but do not want to compromise on quality.

The Japanese Machinery Industry: Future Outlook

Overall, the market for industrial machinery market is getting increasingly competitive.

Recent Gardner surveys and industry statistics show that global production and consumption remain concentrated in a handful of countries, with China dominant and Japan continuing to be a top producer; cyclical demand and trade flows create both opportunities and volatility for exporters.

The Japanese machinery industry still has a dominating market position and its development of overseas markets has been a success, especially in Europe. But the threat of China with its quickly growing machinery production will be a serious challenge in the future.

It will be interesting to see how Japan’s companies will react to this threat. One strategy will likely be to continue being innovative and keeping on developing the European market. There, opportunities are still presenting itself, especially in Eastern European countries such as Poland, Hungary, Slovakia and the Czech Republic.

Also, decreasing domestic production and higher demand for high-quality imports will continue to present opportunities for Japanese machinery makers in the United States.

Photo on top of article: Fanuc FIELD

I didn’t know that Japan is the largest manufacturer of CNC machine tools, it holds about 65% of the market globally that’s astonishing. Japanese technology has been one of it’s kind and best in the market ever since. Thank you, for sharing such knowledge.